Resources

Resources hub for valuation, exits, and growth

Every resource now lives on its own indexable page. Pick a pillar or cluster, then dive into the deep guides with calculators, benchmarks, and action checklists.

Pillar playbooks

Start with a pillar, dive into clusters

- ✓Pricing your SaaS: valuation multiples, calculators, and the 2026 valuation guide.

- ✓Exit readiness: buyer scorecards, resilience playbooks, and founder decision frameworks.

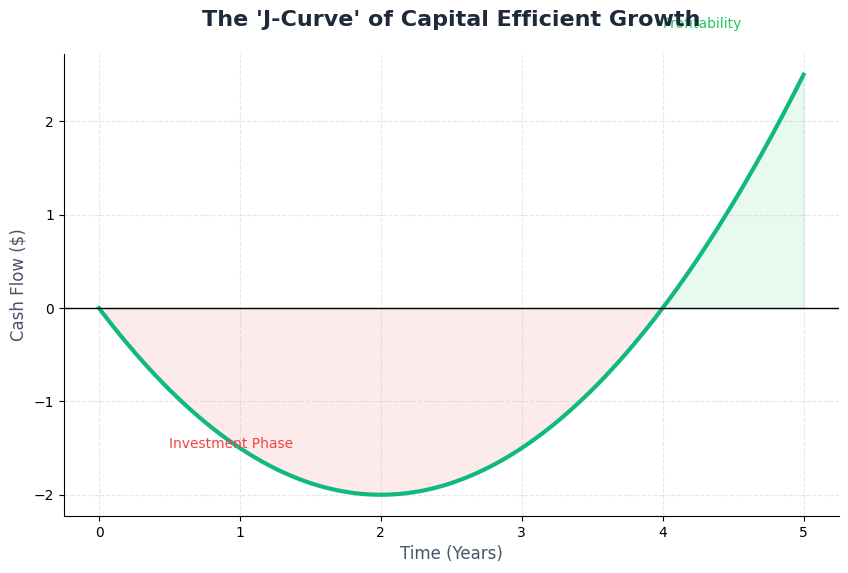

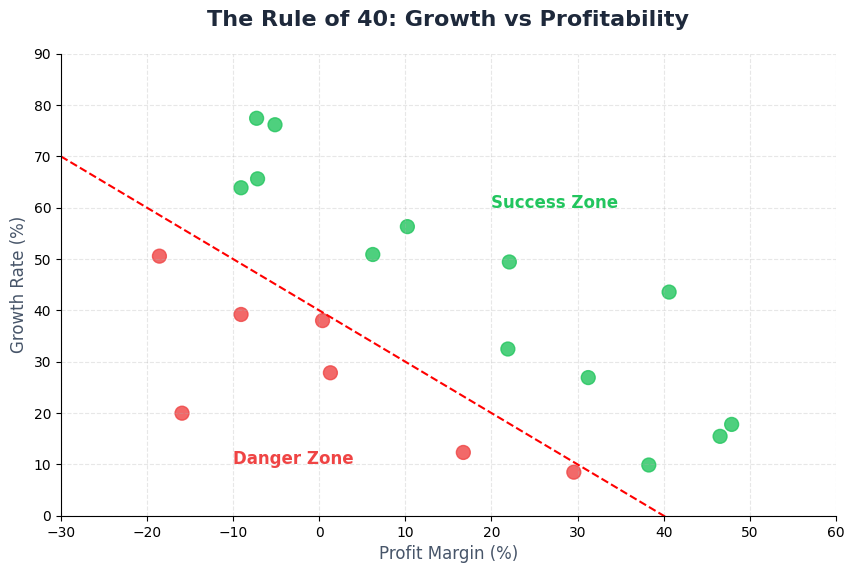

- ✓Efficiency: burn multiples, Rule of 40, NRR, and pricing power experiments.

- ✓Market shifts: AI premiums, positioning, and cluster-level next steps.

New valuation cluster

SaaS valuation deep dive

In-depth playbooks for SaaS valuation scenarios, multiples, and deal context.

Featured guides

Featured resource tracks

Explore the newest playbooks grouped by founder goals. Each guide is indexable and ready to share with advisors, buyers, or your team.

Sell & Exit

Exit timing, diligence readiness, and risk de-risking.

Valuation

Multiples, metrics, and valuation narratives buyers trust.

Growth

Retention, pricing, unit economics, and runway planning.

AI & SEO

AI positioning, answer engine optimization, and content strategy.

- The Future of SaaS with AI: What Founders Should Plan For

- AI-First SaaS: Moat, Defensibility, and Pricing Strategy

- Answer Engine Optimization (AEO) for SaaS in 2026

- Generative Engine Optimization (GEO): Ranking in AI

- SaaS SEO Strategy 2026: Content Clusters That Win

- How to Write SaaS Case Studies That Convert

New resources

Latest founder playbooks

Every new resource is published as an individual page and included in the sitemap for discovery.

Feb 4, 2026

How to Prepare Financials for a SaaS Acquisition

A practical guide to SaaS acquisition financials: ARR bridges, cohort retention, clean P&Ls, and a data room checklist.

Feb 04, 2026

Website Audit Tool: Find Conversion, Trust, and SEO Gaps

Use the Website Audit tool to uncover positioning, conversion, trust, and technical SEO gaps that hold back SaaS valuations.

Feb 3, 2026

SaaS SEO Strategy 2026: Content Clusters That Win

Build SaaS content clusters for 2026 with pillar pages, supporting guides, and conversion paths tailored to AI-driven search.

Feb 2, 2026

Generative Engine Optimization (GEO): Ranking in AI

Learn GEO tactics to rank in generative AI results: structured answers, trust signals, and content clusters built for 2026.

Feb 1, 2026

Answer Engine Optimization (AEO) for SaaS in 2026

A 2026 AEO playbook for SaaS: structure content for AI answers, build trust signals, and increase qualified traffic.

Jan 31, 2026

How to Write SaaS Case Studies That Convert

A step-by-step guide to SaaS case studies that win deals, with structure, proof points, and examples you can replicate.

Jan 30, 2026

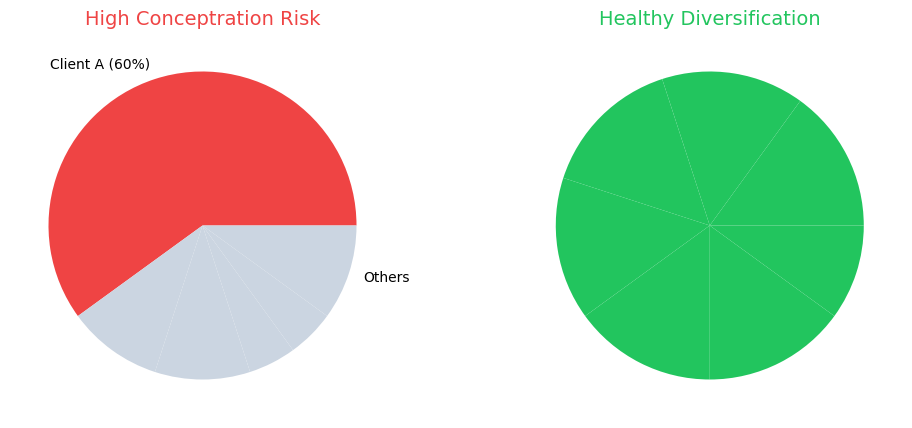

Risk Assessment for SaaS Founders: Red Flags to Fix

A SaaS risk assessment guide with red-flag checklists, examples, and a remediation plan to protect valuation and deal velocity.

Jan 29, 2026

Funding vs Bootstrapping: What’s Best for Your Stage?

A clear framework to choose funding or bootstrapping based on runway, growth goals, and risk tolerance, with real SaaS examples.

Jan 28, 2026

How to Tell If Product-Market Fit Is Real

Signals, metrics, and customer evidence that show real product-market fit for SaaS, with examples and a validation checklist.

Jan 27, 2026

Due Diligence Checklist for SaaS Buyers

A SaaS buyer diligence checklist covering financials, product, security, and retention, with examples and red flags to watch early.

Jan 26, 2026

Burn Rate and Runway: How Long You Have

Calculate burn rate and runway with clear formulas, examples, and a planning checklist to avoid surprise cash crunches.

Jan 25, 2026

LTV/CAC Explained (with SaaS Examples)

Understand LTV/CAC with clear formulas, practical examples, and benchmarks that show when your SaaS unit economics are healthy.

Jan 24, 2026

SaaS Pricing Strategies: Value vs Usage vs Tiers

Compare value-based, usage-based, and tiered pricing for SaaS with decision frameworks, examples, and metrics that guide the right model.

Jan 23, 2026

SaaS Onboarding That Improves Retention

Design onboarding that drives activation and retention with milestone-based flows, success triggers, and real examples for SaaS teams.

Jan 22, 2026

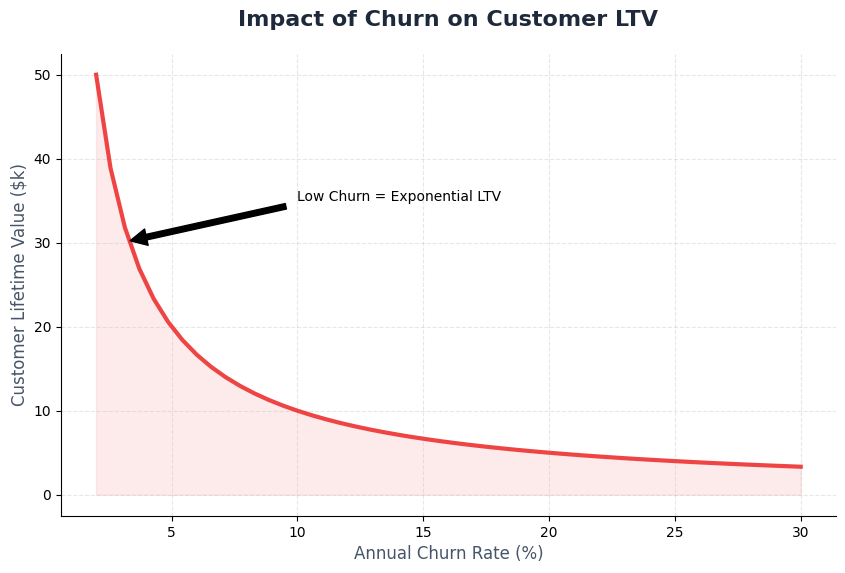

Reducing Churn: A Practical SaaS Playbook

A step-by-step churn reduction playbook with cohort diagnostics, quick wins, and retention experiments you can run in the next 60 days.

Jan 21, 2026

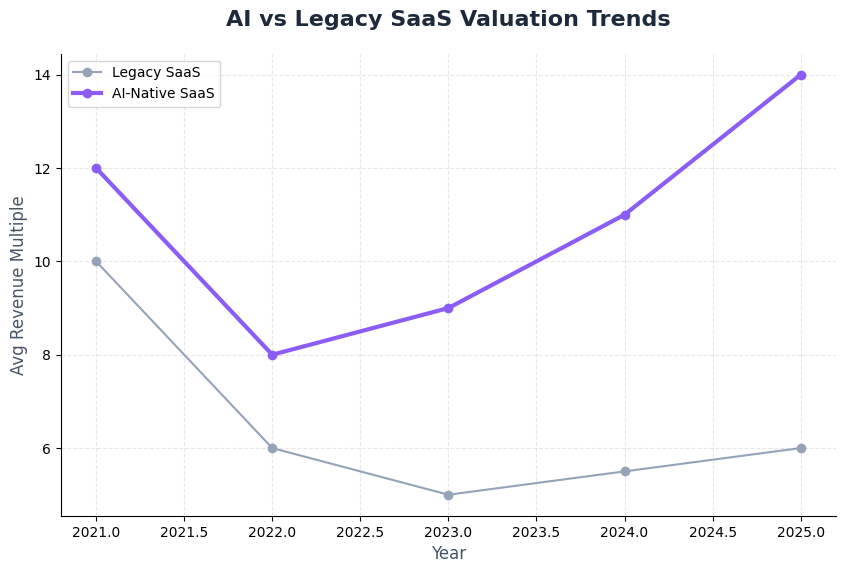

AI-First SaaS: Moat, Defensibility, and Pricing Strategy

A founder playbook for AI-first SaaS: build a defensible moat, price on outcomes, and communicate value to buyers and investors.

Jan 20, 2026

The Future of SaaS with AI: What Founders Should Plan For

A practical view of how AI reshapes SaaS moats, pricing, and buyer expectations, with scenarios, risks, and actions for 2026 plans.

Jan 19, 2026

Typical SaaS Valuation Multiples (and What Moves Them)

Learn typical SaaS valuation multiples by growth and risk, plus the key drivers that expand or compress your multiple and how to defend it.

Jan 18, 2026

How to Prepare Your SaaS for Acquisition (Operational + Financial Checklist)

A diligence-ready acquisition prep guide with operational, financial, and legal checklists plus examples to help SaaS founders avoid costly retrades and delays.

Jan 18, 2026

SaaS Valuation Metrics Buyers Care About (MRR, ARR, Churn, NRR, CAC, LTV, Margins)

A buyer-focused guide to the SaaS valuation metrics that drive multiples, with examples, red flags, benchmarks, and a clean narrative you can defend today.

Jan 18, 2026

When to Sell Your SaaS Company: A Decision Framework

A grounded decision framework to decide when to sell your SaaS company, with scenarios, risk trade-offs, timing signals, and founder examples you can act on.

Jan 15, 2026

SaaS Exit Calculator Logic: How We Do The Math

Understand the math behind valuation tools and how to sanity-check your exit numbers before negotiating.

Dec 1, 2025

NRR Mastery: The Metric Builders Care About

Why Net Revenue Retention is the ultimate proof of product-market fit and how to drive it above 110%.

Nov 5, 2025

SaaS Growth Calculator Guide: Modeling the Path to $10M

How to use growth modeling to project your path to $10M ARR and beyond. Master the variables that move the needle.

Oct 12, 2025

Free Valuation Calculator: How it Works

A deep dive into the methodology behind our free valuation tool. Learn how we weight growth, churn, and margins.

Sep 12, 2025

The AI SaaS Valuation Bubble: 2025 Market Analysis

AI hype is distorting traditional SaaS multiples. Learn how to separate true AI value from "AI-wrapper" noise.

Sep 02, 2025

SaaS Exit Strategy: The 12-Month Roadmap

Don't wake up and decide to sell. Maximize your exit value with this 12-month preparation timeline and checklist.

Aug 28, 2025

SaaS Growth Metrics That Matter: The 2025 Handbook

LTV, CAC, Churn, and Burn. Which metrics actually drive valuation? A deep dive into the numbers investors analyze.

Aug 21, 2025

Micro-SaaS Valuation Guide: Under $1M ARR

Valuing small SaaS businesses is different. Learn the rules for confident buying and selling of micro-SaaS.

Aug 19, 2025

The Rule of 40 in SaaS Explained: 2025 Guide

Balance growth/profit. Learn why investors prize companies hitting the 40% benchmark and how to calculate it.

Aug 15, 2025

The Ultimate SaaS Valuation Guide: 2025 Edition

The definitive handbook on how SaaS companies are valued. Multiples, metrics, and methodology for Seed to Series C.

Pillar tracks

Start with a pillar page

Each pillar frames the story buyers expect. Every category page now links to its articles so Google and your team can index them directly.

Valuation fundamentals

PillarBuild the baseline story buyers and investors expect before they look at your numbers.

Exit readiness

PillarTurn your operating reality into a diligence-ready package with clear documentation.

Efficiency & metrics

PillarDemonstrate efficient growth through burn multiples, retention strength, and pipeline clarity.

Tools & calculators

ToolsUse calculators and templates to benchmark your position and test scenarios.

Cluster deep-dives

Pick your next step

Choose a theme to find related posts that reinforce the same narrative and metrics.

AI & market shifts

ClusterPosition your product and pricing in markets reshaped by AI and changing buyer expectations.

- AI SaaS Valuation Bubble: How to Prove You Deserve a Premium

- Pricing Power Playbook: Raising ARPU Without Losing Retention

- AI Market Map Reset: Reframing Your Category Before Buyers Do

- AI Positioning Battlecard: Proving Differentiation Against Fast Followers

- AI Data Moat Playbook: Proving Defensibility Without Owning the Model

- AI Pricing with Usage Guardrails: Protect Margin and Buyer Trust

- AI Enterprise Readiness: What Buyers Expect Before Scaling Spend

SaaS valuation deep dive

ClusterIn-depth playbooks for SaaS valuation scenarios, multiples, and deal context.

- What Is SaaS Valuation? (With Examples)

- ARR vs EBITDA vs SDE (Which Metrics Matter for SaaS Valuation?)

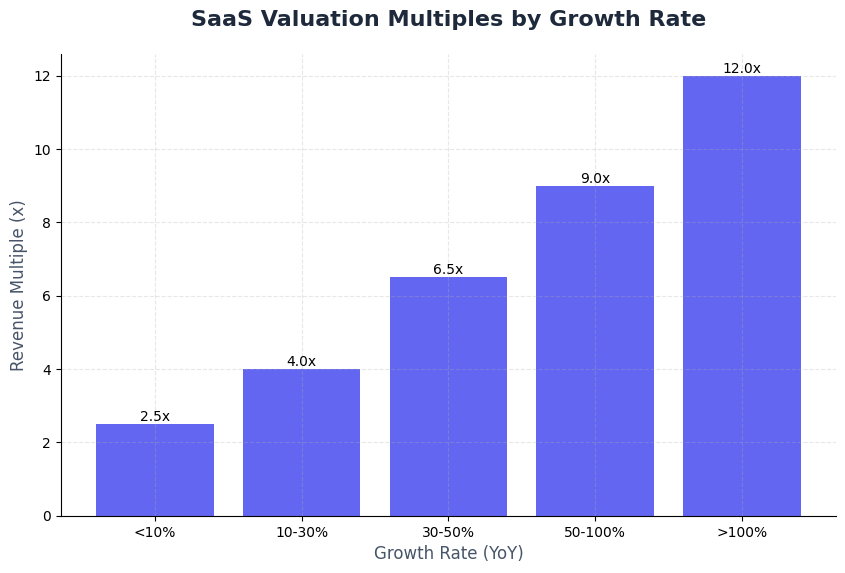

- SaaS Valuation Multiples (Benchmarks + What Moves Your Multiple)

- How to Value a SaaS Company (Step-by-Step)

- SaaS Valuation 101: A Founder-Friendly Primer

- How Much Is My SaaS Worth? A Practical Valuation Range

- ARR, MRR, and Valuation Multiples Explained

- Valuation Multiples by Growth Rate: Benchmarks for SaaS

- Rule of 40 Valuation Impact: When Efficiency Drives Value

- Churn and Retention: The Valuation Multiplier You Control

- CAC, LTV, and Payback: How Unit Economics Shape Valuation

- Gross Margin and Valuation: Why Margin Quality Matters

- Valuation for Pre-Revenue SaaS: How Investors Think

- Valuation for Bootstrapped SaaS: Pricing Efficiency

- Valuation for Enterprise SaaS: Proving Durability

- Valuation for B2C SaaS: Growth, Churn, and ARPU

- Valuation for Marketplaces vs. SaaS: Key Differences

- Discounted Cash Flow (DCF) for SaaS: When It Matters

- Comps Analysis for SaaS Valuation: Building Your Benchmark Set

- SaaS Valuation During Fundraising: How to Position Your Round

- SaaS Valuation for M&A: How Buyers Price Deals

- Common SaaS Valuation Mistakes (and How to Avoid Them)

- SaaS Valuation Checklist Template (Copy/Paste)

Risk & resilience

ClusterSurface and neutralize fragility before a buyer’s risk committee does it for you.

Latest resources

Freshly published

Each article is a standalone URL with full templates, benchmarks, and checklists to keep click depth low and utility high.

What Is SaaS Valuation? (With Examples)

Understand how SaaS valuation works, what drives a higher multiple, and how to explain your value with simple, defensible examples.

ARR vs EBITDA vs SDE (Which Metrics Matter for SaaS Valuation?)

Understand when ARR matters most, when EBITDA or SDE becomes relevant, and how buyers triangulate SaaS value using all three.

SaaS Valuation Multiples (Benchmarks + What Moves Your Multiple)

Learn how SaaS valuation multiples work, what shapes the range, and how to improve the multiple buyers will defend.

Stay in the loop

Get new pillars & clusters in your inbox

We share valuation updates, exit prep checklists, and pricing experiments as soon as they ship.

Latest SaaS + Tech Business Trends